Just imagine the chaos that would ensue if no apparent system was in place for filing taxes! As a former attorney now focusing on familiarizing individuals with tax-related nuances, I understand that accurate tax filing forms the cornerstone of financial responsibility. Among numerous forms, the IRS tax form 8962 printable often crops up in queries. Understandably, its completion is pivotal to claiming the Premium Tax Credit (PTC), aimed at offsetting the cost of monthly health insurance acquired through the Marketplace.

Printable 8962 Form: Required Information

To ensure accurate tax filing, gathering the necessary documents is essential. Before filling out the printable IRS Form 8962, certain fundamental documents must be within arm's reach. These include:

- Form 1095-A (Health Insurance Marketplace Statement),

- Form 1040,

- 1040A or 1040EZ (individual's tax return),

- last year’s tax return.

The chance of making a mistake reduces drastically in the presence of all pertinent information.

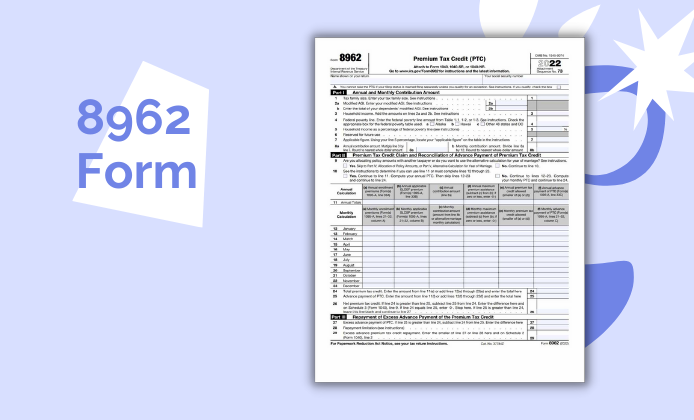

A Step-by-Step IRS Form 8962 Walkthrough

Once all necessary documents have been gathered, it's time to complete the printable 8962 form. This form can present a challenge, but it essentially asks for information about a taxpayer’s family size, household income, Federal poverty level, and premium amounts. Each component affects how much of a tax reward you might receive.

Understanding Deductions and Credits

Understanding deductions and credits significantly contributes to maximizing your return or lowering your due tax. Completing your free printable 8962 form and understanding your eligibility for credits such as the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), or the American Opportunity Credit (AOTC) can influence your tax obligation considerably.

Tax Form 8962 Review for Accurate Reporting

Once you've filled everything out, it's crucial to double-check your information. Misreported numbers or overlooked details can lead to unwelcome requests for additional information from the IRS. Thus, even when it’s your free IRS Form 8962 printable, it is important to review every field against your supporting documents to ensure every detail aligns.

Choosing Your Filing Option

Upon ensuring the correctness of the information in your form, two options are present for form submission:

- e-filing,

- traditional mailing.

While e-filing offers speed and direct communication, mailing the filled-out form can also be an option if time is not critical. However, in both cases, your free printable 8962 form must be completed thoroughly and accurately per the IRS guidelines.

The tax filing process can seem overwhelming, but it can be managed easily with the right direction and patience. Needless to say, timely and precise tax filing not only fulfills your fiscal obligation as a responsible citizen but also ensures achieving maximum financial benefit in terms of returns and relief procedures provided by the IRS.

Printable IRS Form 8962

Printable IRS Form 8962

2022 Form 8962 Instructions

2022 Form 8962 Instructions