Inside the complicated world of IRC (Internal Revenue Code), tax form 8962 is a document that taxpayers often find puzzling. Initially, before we take a deep dive into the completion process, it's crucial to understand tax form 8962 instructions and what the PTC is used for. Officially referred to as Form 8962, Premium Tax Credit (PTC), this document attracts taxpayers who have benefited from premium tax credits due to their health insurance marketplace policies. The form's primary purpose is to reconcile the difference between the advance credit payment for health coverage and the premium tax credit.

The Form 8962 Instructions Overview

To start, it's important to note that only those who have benefited from PTC must file Form 8962. Whether you end up paying back a portion of the credit or getting a portion will essentially depend on your final income.

For those who have been trying to understand the instructions for the 8962 tax form, here we will break down the procedure into four fundamental steps:

- Reflect on the size of your family and the Federal Poverty Line (FPL). This will determine the maximum amount of PTC that you are eligible for.

- Next, jot down the Premium Tax Credit (PTC) initially paid to your insurance company during the year.

- Now calculate the actual PTC you are eligible for, considering your income and family size.

- Finally, reconcile the two by comparing the figures above (Advance PTC and the Actual PTC).

Understanding these steps and instructions for the 8962 form for 2022 can develop the basis for you to navigate easily through this otherwise convoluted document.

Tips For Completing IRS Form 8962 in 2023

Here are some tips to remember when it comes to instructions for IRS Form 8962:

- Double-check every entry you inscribe - From your name and Social Security number to your estimated family size and income, ensure all details are accurate.

- Understand that the higher your income, the lower your Premium Tax Credit will be.

- Maintain proper records - It's imperative if you use the health insurance marketplace. These records can serve as proof if the IRS flags discrepancies.

Prepare the 8962 Form Early For Tax Seasons

With tax season around the corner, being prepared and understanding 2022 Form 8962 instructions helps eliminate costly mistakes. Deciphering Form 8962 can feel daunting, but by understanding the process and keeping these pointers in mind, you can make your tax filing journey stress-free.

Printable IRS Form 8962

Printable IRS Form 8962

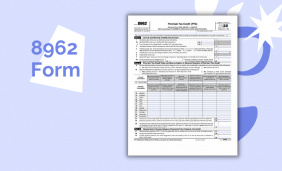

2022 Form 8962 Instructions

2022 Form 8962 Instructions