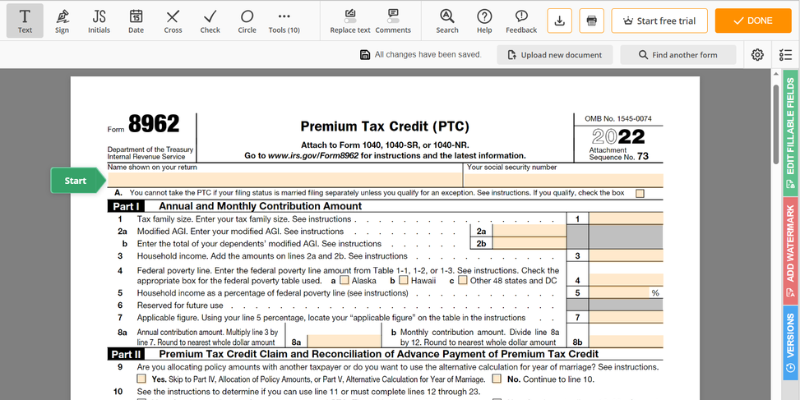

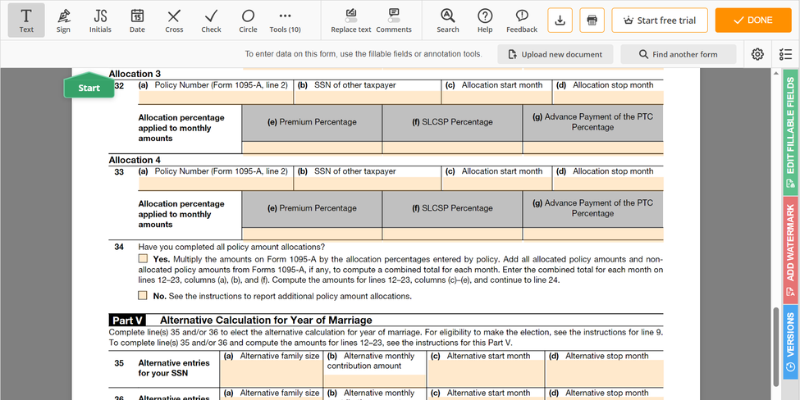

IRS Form 8962, used primarily to reconcile premium tax credits associated with health insurance plans purchased through the Marketplace, is a requisite document for taxpayers eligible for this credit. It's a crucial form for those who bought health coverage through the Marketplace, ensuring they receive the correct tax credit amount. Refer to the 2022 IRS Form 8962 instructions on our website. It provides detailed information on how to fill it out based on your specific circumstances.

There's immense value found in our website, 8962-form.com. With our resource, you can access the blank 8962 form for 2022, along with step-by-step methods to fill it out. Our friendly platform even includes examples, making the complex process relatively more straightforward. Furthermore, Form 8962 in PDF format available on the site offers the advantage of easily printable and shareable content. Ultimately, these guides and resources can significantly simplify completing this critical tax form and avoid misunderstandings or errors.

IRS 8962 Form for 2022: Target Audience & Purpose

The 8962 tax form is mainly designed for those who obtained health coverage through the Marketplace and need to calculate their premium tax credit (PTC). It's essential for taxpayers who benefited from advanced payment of the PTC or who want to claim the PTC on their tax return to fill out Form 8962 along with the 1040 copy.

However, there are certain exemptions to this requirement:

- Firstly, individuals not enrolled in Marketplace coverage for any month of the year do not need to complete IRS Form 8962 printable for 2022.

- Similarly, taxpayers who opted for the married filing separately status (with rare exceptions) won't be required to fill out the Internal Revenue Service Form 8962.

- Finally, individuals covered under another comprehensive health insurance plan for the entire year are exempted.

It’s crucial to properly assess your individual circumstances to ensure compliance with IRS requirements while maximizing your eligible taxation benefits.

Instructions for a Blank Form 8962: From Filling to Filing

- Head to the homepage and download the IRS tax form 8962 printable for accurate filing.

- Begin by filling out your basic information in Part I.

- Now it’s time for Part II.

- First, using Table 2 on the IRS instructions Form 8962 for 2022, find your annual contribution amount.

- Input this value in lines 5 to 8, column B. For lines 9 to 11, refer to your completed IRS Form 1040.

- Now, divide the annual contribution amount by 12 to get the monthly contribution amount.

- Insert this value in lines 12 to 23, column B. If you received the premium tax credit for only a part of the year, fill in the months that apply.

- Review your income details in Part III meticulously to avoid errors.

- When on Part IV, a Form 8962 example can be a helpful reference for Premium Tax Credit claim computations.

If your provided income during the year was less than the anticipated amount, you might have to repay a certain amount of your received premium tax credit. This section helps you compute that repayment. However, a cap exists based on your income, which can limit this repayment. Report the resulting amount on your 1040 tax return.

- Finally, cross-verify all entries before submitting Form 8962 to the IRS for 2022 and retain a copy for future reference.

File IRS Form 8962 Before the Deadline

Filing your taxes accurately and promptly is crucial, especially if you wish to claim the PTC. As a rule, IRS Form 8962 (Premium Tax Credit) for 2022 should be submitted by April 15th, similar to most tax-related documents, as this is the national deadline for filing income tax returns. However, if an extension is needed, the IRS permits one to be requested, extending the deadline to October 15th. You should note that the extension is for filing your return, not for paying any owed taxes. If necessary, seek professional advice to avoid potential penalties or complications.

Instructions for IRS Form 8962 (Premium Tax Credit)

Instructions for IRS Form 8962 (Premium Tax Credit)

Fillable Form 8962

Fillable Form 8962

IRS Form 8962 (PDF)

IRS Form 8962 (PDF)

Printable IRS Form 8962

Printable IRS Form 8962

2022 Form 8962 Instructions

2022 Form 8962 Instructions